They say a nation’s industry is only as strong as its exports. So, how does Romania’s music industry measure up in this regard?

Methodology

It would be helpful to assess the ticket sales of Romanian artists while touring abroad, but unfortunately, the data is either not compiled or unavailable.

What is available is detailed data from UCMR-ADA, the Romanian Musical Performing and Mechanical Rights Society. This local Collective Management Organization (CMO) oversees the song side of royalties (songwriters, composers, lyricists), while the recording royalties are managed by Credidam.

The latest yearly report from UCMR-ADA (as of 2023) provides insights into royalties collected abroad for Romanian artists (the export); and the payments made to foreign Performing Rights Organizations (PRO) for the use of international music in Romania (the import).

This data enables an evaluation of export revenue and offers a perspective on the export/import balance.

We narrowed the data to focus on the top 11 exports of Romanian music and the top 11 international music imports into Romania, based on the amounts exchanged with those country’s PRO’s.

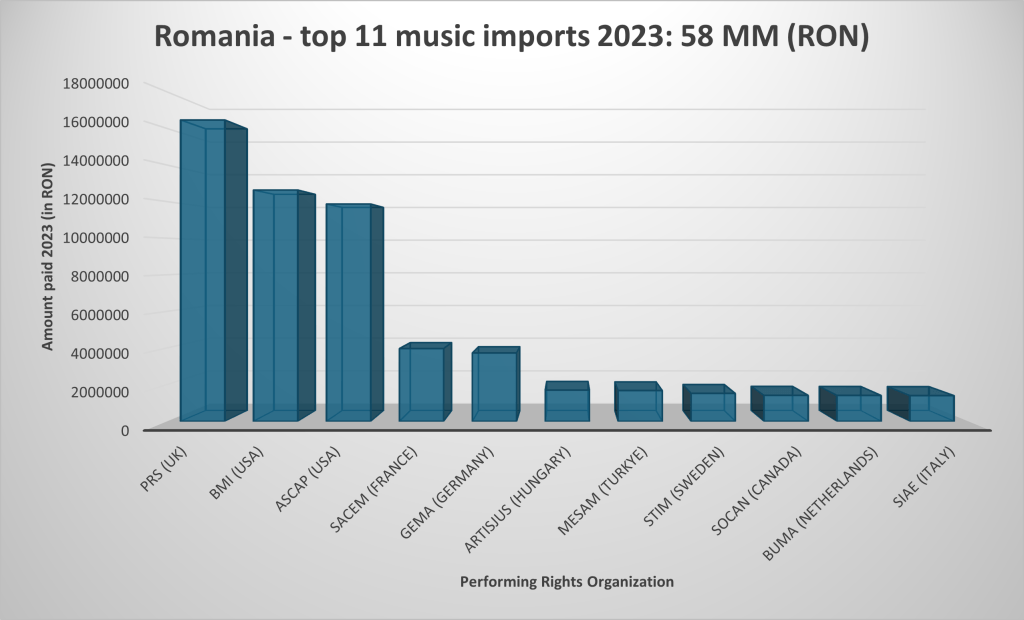

The import

The Romanian music industry top 11 imports are valued at around 13 million USD.

As expected, Romanians are drawn to the leading music markets of the USA and UK. Canada also contributes to the English-speaking imports with its top artists like Drake and The Weeknd.

French artists have been well represented since the 1960s, thanks to the communist regime’s openness to left-leaning French influences. Similarly, German artists gained popularity during the 1980-1990s Eurodance wave, with acts like Modern Talking, La Bouche and Masterboy making a significant impact on Romanian airwaves. Italian music continues to enjoy immense popularity in Romania as well.

Swedish music is widely enjoyed in Romania, thanks to legacy artists like ABBA, Ace of Base, Dr. Alban, and Roxette, along with several contemporary performers.

Significant amounts are paid for Hungarian artists’ music enjoyed by Romania’s largest minority. Similarly, music from Turkey holds substantial cultural influence in Southern Romania.

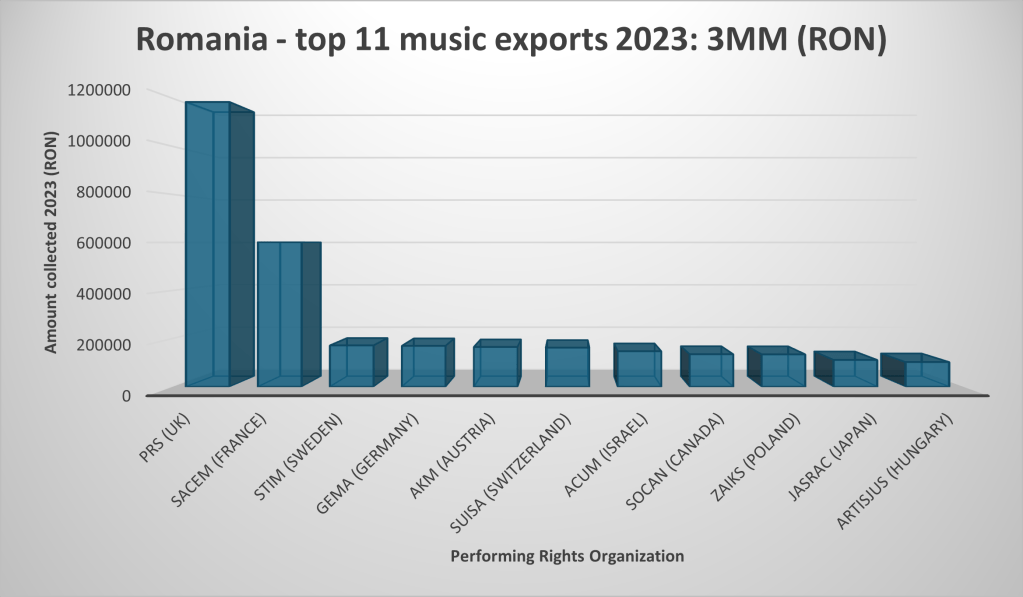

The export

The Romanian music industry top 11 exports are valued at around 673k USD.

This represents about 5% of its imports and 2% of the revenue collected inside Romania’s territory (146.3MM RON).

Romanian-composed music enjoys the most popularity in the UK, France, Sweden, and Germany. In contrast, it is largely overlooked in the USA, Canada, and Turkey when compared to imports.

However, it finds an intriguing niche in countries like Israel, Poland, and Japan—an interesting opportunity for future export strategies.

Italy presents a fascinating case: while royalties collected for songs (both performing and mechanical) amount to only 90k RON, a licensing scheme for online use generated an astonishing 7.4 million RON! It raises the question: why hasn’t this licensing model been adopted in other regions?

Conclusion

There are lots of countries that strategize investments in their music industry. South Korea is a great example to follow. Sounds Australia, too.

Canadian federal government announced last March the launch of the Canada Music Fund. Canada House is always present at SXSW.

Romania’s music industry exports account for just 5% of its imports, making it a net importer in this sector.

The country boasts a rich pool of musical talent that remains underutilized and could benefit from a strategy plus greater support at the national, regional, and local government levels.

My services are available for artists, their teams and anyone interested in the music industry. Use the CONTACT page.

[…] making it a minor player in terms of profitability. Romanian music struggles for airtime due to competition with imported tracks. A potential strategy could involve concentrating on the seven radio stations that contribute to […]